Spiff

Product Design

Spiff was a simple, social savings app, designed for saving towards shared goals.

Among the general challenges that come with breaking into the FinTech space, and competing with banks, designing a financial app that promotes saving socially was a huge deal.

The UX challenge

Saving is not new, it’s just tied very heavily to banking, banks and balances. People are familiar with terms like ‘deposit’, ‘withdrawal’, ‘transaction’ and ‘interest’. When people think of money, they think of banks.

The task was to design something that reformatted people's relationship with their savings. A product that fit seamlessly into the their lives with carefully considered nods to their current understanding of money and all the bank-y things associated with it.

There was no benefit to completely dissociating from familiar financial ideas, so instead the emphasis was placed on enhancing the process of saving. To make saving goal-driven, easy and visually satisfying.

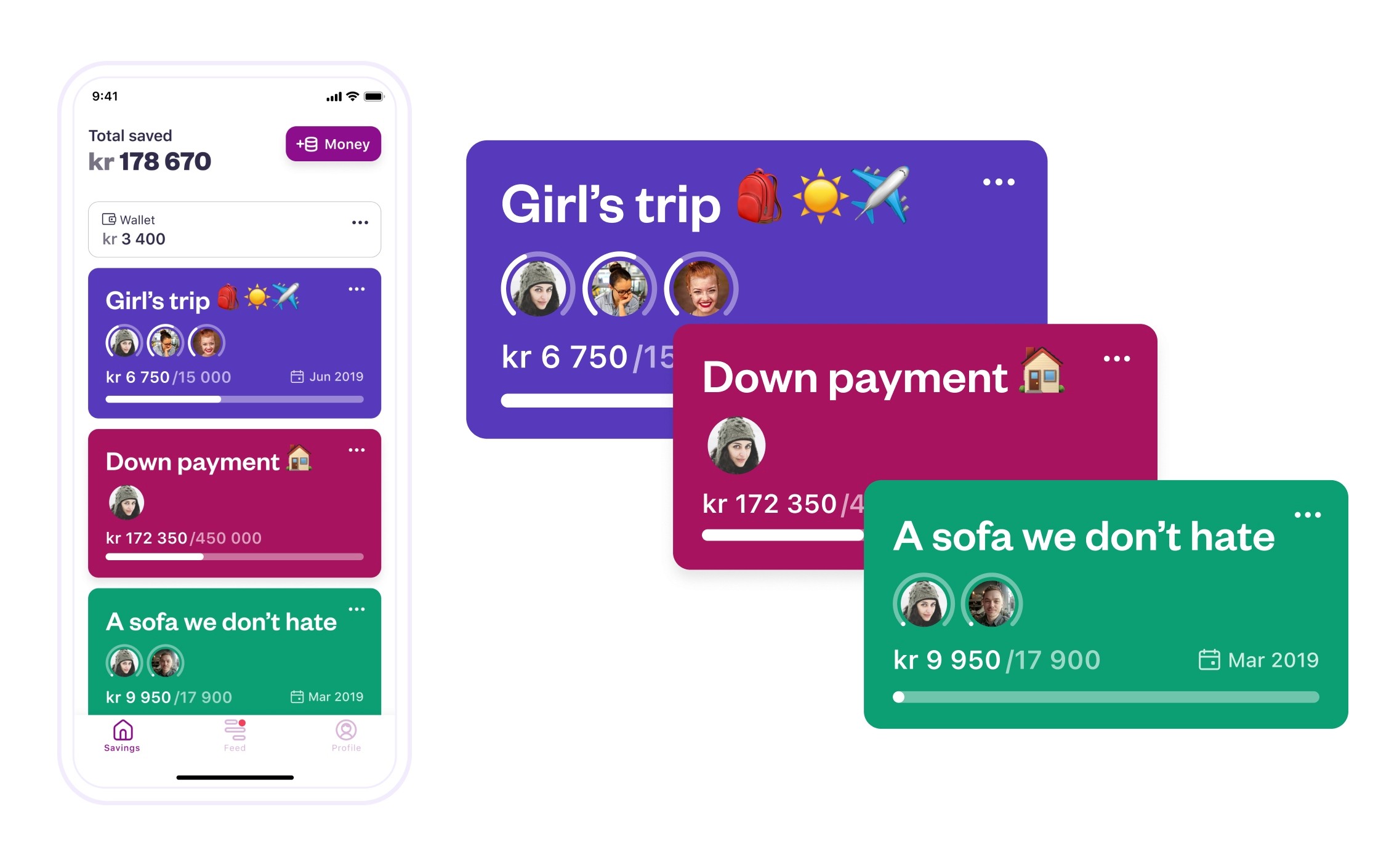

Progress-driven saving

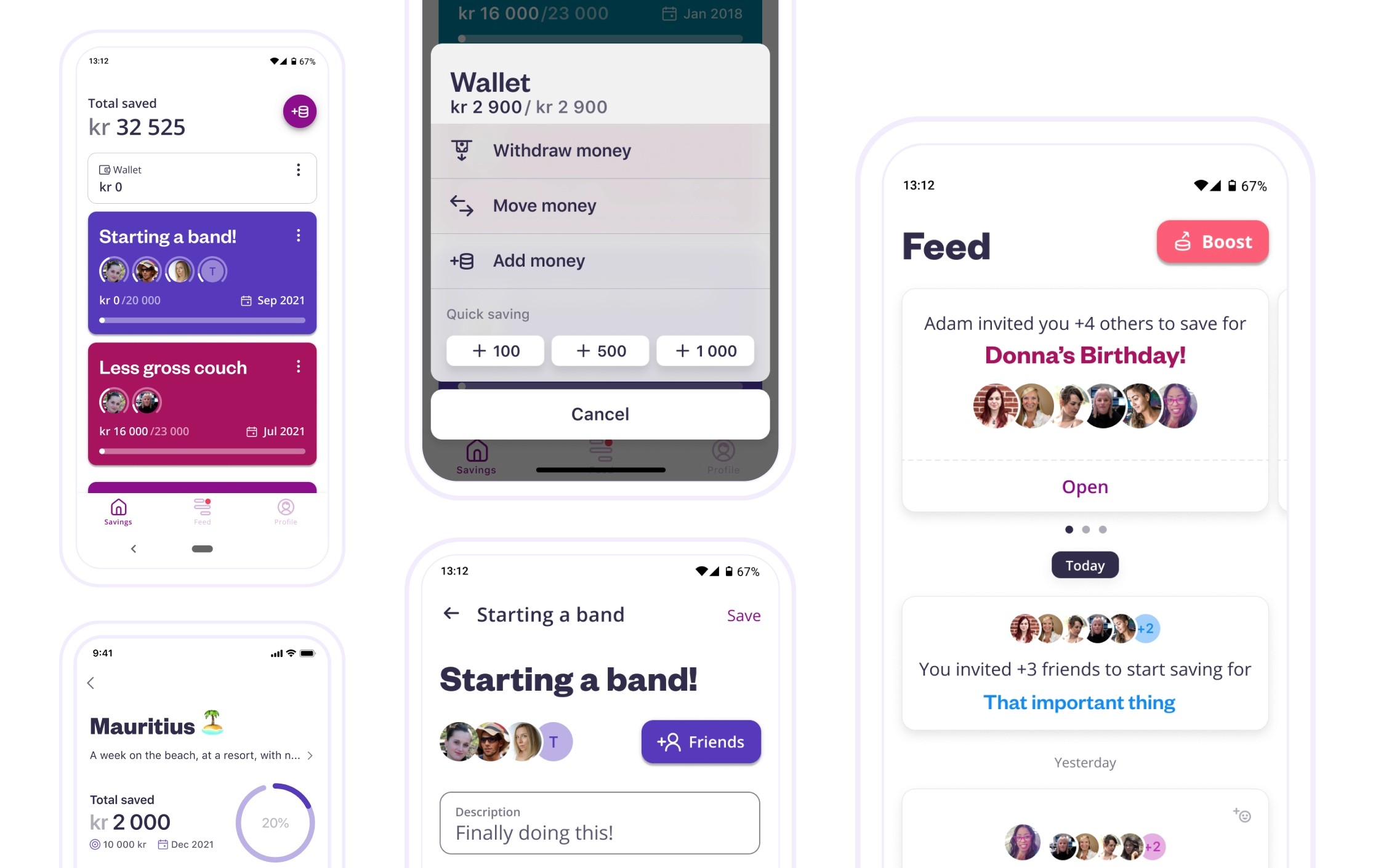

The savings dashboard required neat visualisation of overall progress, as well as individual user progress within savings plans. A huge deviation from looking at the balance of your savings account.

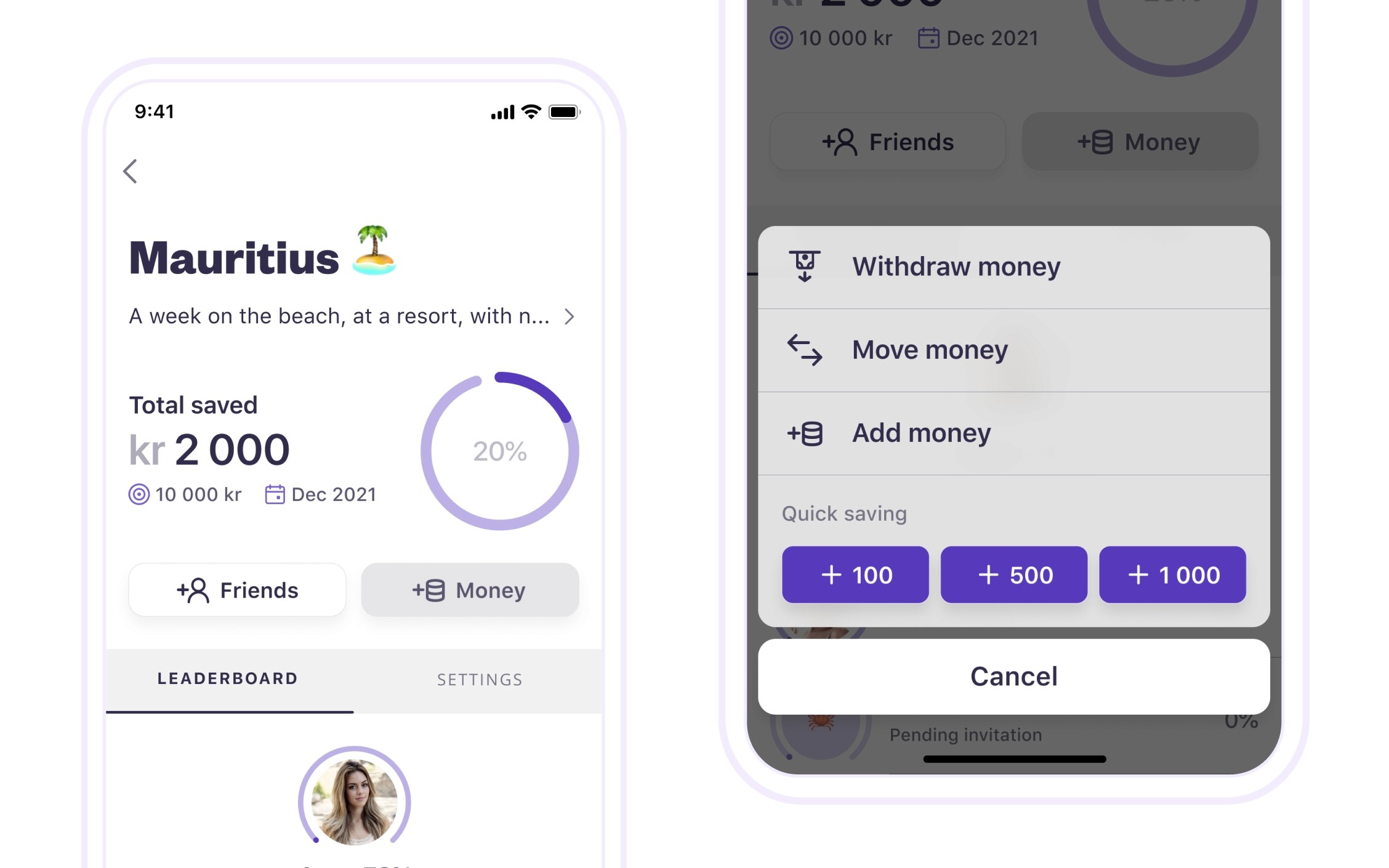

The user had the ability to add money to their savings wallet (for later allocation), to a savings plan, or to move money between savings plans as needed. A much more flexible and interactive space to engage with your money...and your friends.

A tap into each savings plan revealed a more granular list of settings, like target, and deadline, as well as a leaderboard to encourage healthy competition. An action sheet reveals the same flexibility as the dashboard, including some quick amounts for impulsive saving.

Taking the "personal" out of finance

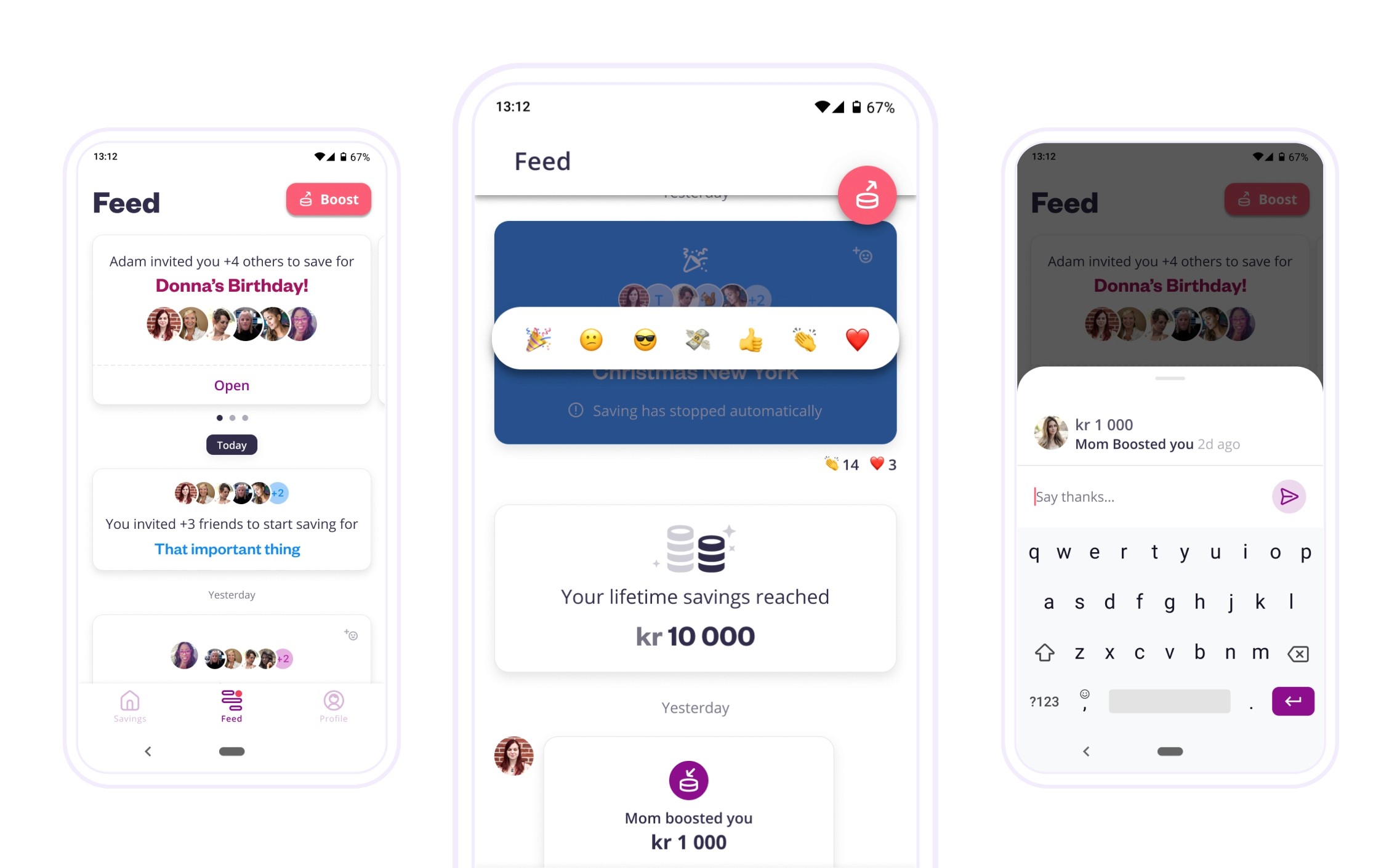

Originally the app started out with a traditional “inbox” where users would receive notifications about plans they were invited to join, or changes to those plans.

User feedback revealed that users wanted to interact with each other inside the app - and kept requesting a chat feature.

After extensive research, we decided against chat and instead introduced an events Feed, with card-style visualisation of invitations, progress milestones and various other interactions within social savings plans. Users were also able to react to events with emojis.

We also introduced the ability to send money to friends as a “Boost” and to reply with a short message.

What’s happened next?

After leaving Spiff in 2019, the product was still being developed and improved, with plans to include more features and levels of social interactions around savings.

In 2022, having been Norway's oldest startup, the company was unable to sustain itself and had to shut down operations.